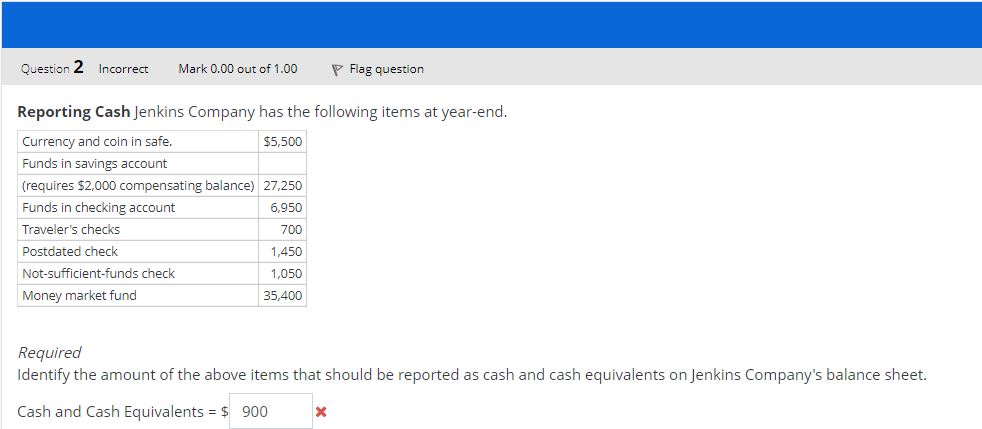

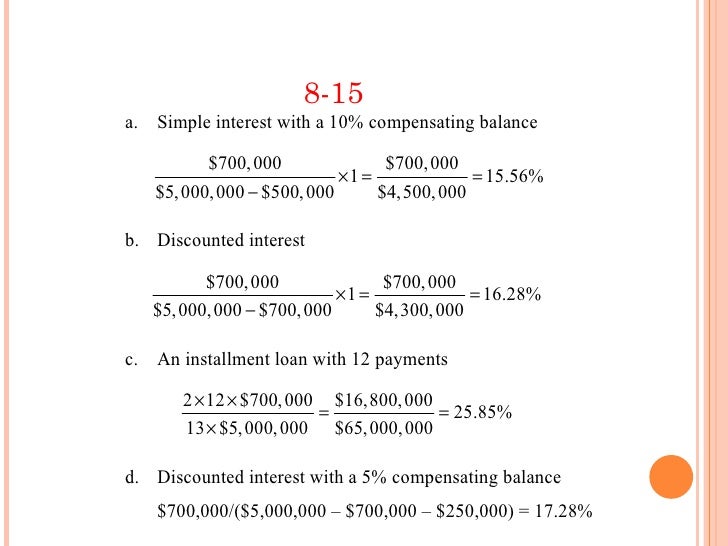

What Is A Compensating Balance? | Bank regulators are less concered with the credit of the borrower for an obligation secured by compensating balances which is a compensating collateral account or certificate of deposit. Sometimes referred to as an offsetting balance, the purpose of the compensating balance is to offset the expenses associated with extending and servicing the loan. An excess balance that is left in a bank to provide indirect compensation for loans extended or services provided. The bank loans the clothing store's compensating balance to other borrowers, and profits on the difference between the interest earned and the lower rate of interest paid to the clothing store. Banks set compensating balance requirements for the borrower as a means of keeping such. Why do borrowers agree to a compensating balance? The bank loans the clothing store's compensating balance to other borrowers, and profits on the difference between the interest earned and the lower rate of interest paid to the clothing store. Timealso, com′pensated bal′ance, compensa′tion bal′ance. An excess balance that is left in a bank to provide indirect compensation for loans extended or services provided. A compensating balance is a minimum deposit that must be maintained in a bank account by a borrower. Bankers often offer this as a means of obtaining a more favorable interest rate on loans extended to existing bank customers. If you fail to repay the loan, the bank can seize the compensating balance. A compensating balance is a minimum deposit that must be maintained in a bank account by a borrower. For instance, a company takes a loan of $50,000 from a bank and agrees never to use $5. The primary objective of such a balance is to reduce the lending cost of a borrower. The lender pays a reduced amount to the borrower, but receives interest on the full amount of the loan. What is a compensating balance?a.savings account balances. Compensating balance is the least or minimum balance that an organization or an individual needs to keep with the lender. A bank account balance that a corporation agrees to maintain with a current or potential lender. Compensating balances is defined as the minimum amount which the borrower keeps with the bank. A material compensating balance must be disclosed regardeless of the classification of the cash. The effective interest rate of a compensating balance installment loan is higher than a regular loan. The bank loans the clothing store's compensating balance to other borrowers, and profits on the difference between the interest earned and the lower rate of interest paid to the clothing store. B.margin accounts held with brokersc.temporary investments serving as collateral for outstanding loansd.minimum deposits required to be maintained in connection with aborrowing arrangement. Compensating balances are minimum balances that may be maintained in an account and still meet the requirements for a loan. Compensating balance deposits that offset loans compensating balance is when a bank takes deposits from depositors and then uses that money to lend to those. In the event that the compensating balance. Banks have named such balances compensating balances in the sense that the bank gives a credit to, or compensates, borrowers for balances the borrower can do nothing about but which the bank can use. Compensating balance meaning, definition, what is compensating balance: If you fail to repay the loan, the bank can seize the compensating balance. Why do borrowers agree to a compensating balance? Bank regulators are less concered with the credit of the borrower for an obligation secured by compensating balances which is a compensating collateral account or certificate of deposit. Sometimes referred to as an offsetting balance, the purpose of the compensating balance is to offset the expenses associated with extending and servicing the loan. Compensating balances are minimum balances that may be maintained in an account and still meet the requirements for a loan. Bankers often offer this as a means of obtaining a more favorable interest rate on loans extended to existing bank customers. For instance, a company takes a loan of $50,000 from a bank and agrees never to use $5. Banks set compensating balance requirements for the borrower as a means of keeping such. In the us, an amount of money that must.: In financing with receivables, what is the difference between a secured borrowing and a sale of receivables? One end of the bar is released by. The requirement for a compensating balance is most common with corporate rather than individual loans. The purpose of this balance is to reduce the lending cost for the lender, since the lender can invest the cash located in the compensating bank account and keep some or all of the proceeds. Compensating balances is defined as the minimum amount which the borrower keeps with the bank. If you fail to repay the loan, the bank can seize the compensating balance. A compensating balance is a minimum deposit that must be maintained in a bank account by a borrower. Why do borrowers agree to a compensating balance? Compensating balance is usually calculated as10% of the amount of the loan.the account where the funds are held are typically. Compensation of employees (ce) is a statistical term used in national accounts, balance of payments statistics and sometimes in corporate accounts as well. A compensating balance is a minimum deposit that must be maintained in a bank account by a borrower. Why do borrowers agree to a compensating balance? The lender pays a reduced amount to the borrower, but receives interest on the full amount of the loan. Timealso, com′pensated bal′ance, compensa′tion bal′ance. Balance (the difference between the totals of the credit and debit sides of an account). A balance wheel in a timepiece , designed to compensate for variations in tension in the. Hypernyms (compensating balance is a kind of.): Compensating balances is defined as the minimum amount which the borrower keeps with the bank. The requirement for a compensating balance is most common with corporate rather than individual loans. If you fail to repay the loan, the bank can seize the compensating balance. The compensating balance is often used to offset a portion of the cost that a bank faces when extending a loan or credit to an individual or business,.

What Is A Compensating Balance?: Banks have named such balances compensating balances in the sense that the bank gives a credit to, or compensates, borrowers for balances the borrower can do nothing about but which the bank can use.

Source: What Is A Compensating Balance?

0 comments:

Post a Comment